In leading off the opening arguments in Epic's long-anticipated bench trial against Apple, the Fortnite studio noted that it was "not suing for damages" or a "special deal." Instead, Epic's counsel said, it was "suing for change, not just for itself, but for all developers."

While "Epic is far from the only unhappy Apple developer and distributor," Epic's lawyers said it just happened to be the one company that could "finally [say] enough to Apple's monopolistic conduct" by "taking on the world's largest company" in court over the matter.

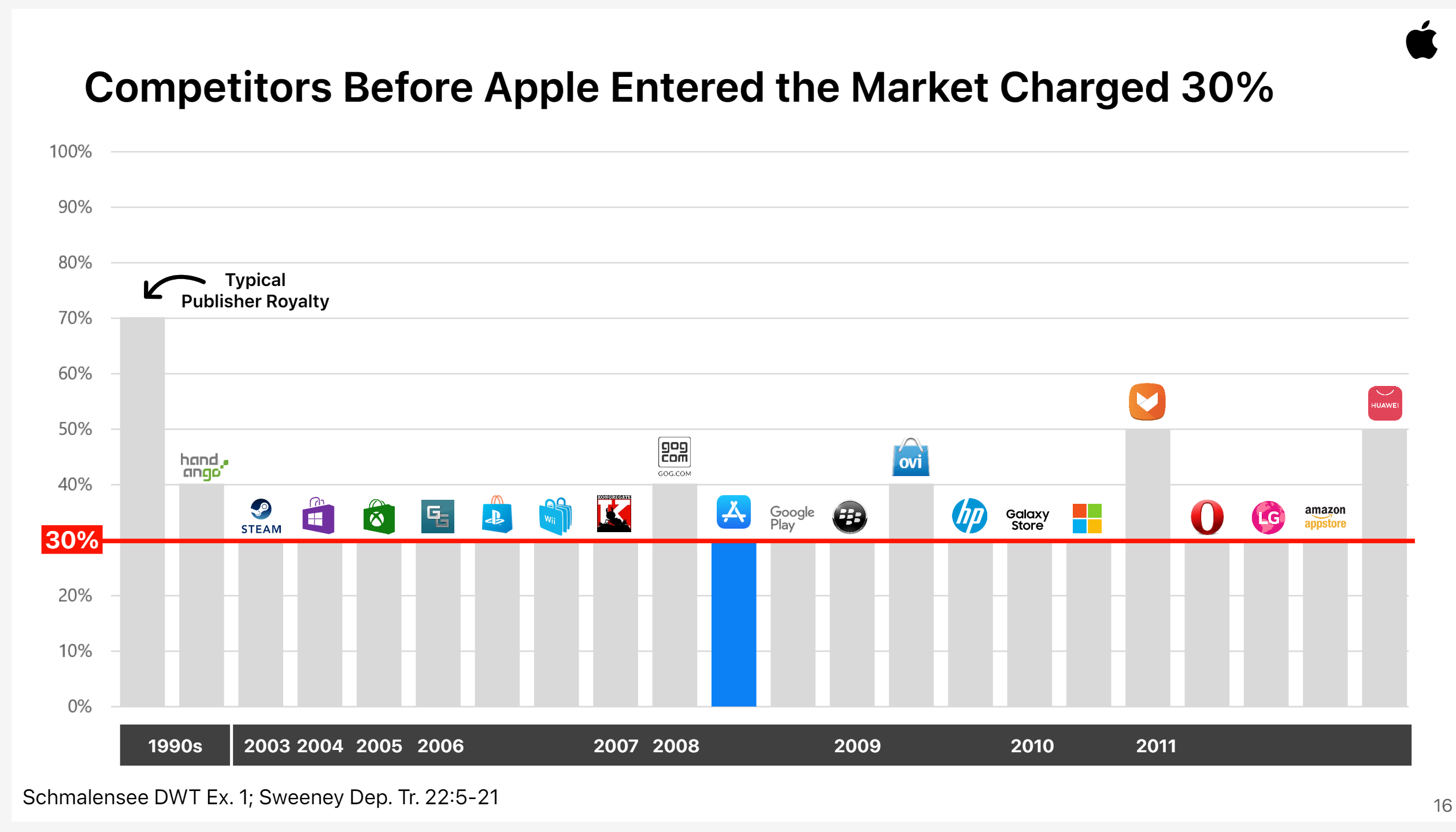

Apple, meanwhile, used its opening arguments to characterize Epic's lawsuit as "just an attack on Apple's 30 percent commission that Epic does not want to pay" and Epic as a company that "has decided it doesn't want to pay for Apple's innovations anymore."

"Rather than investing in innovation, Epic [is] investing in lawyers and PR... to get the benefits that Apple provides for free," Apple said.

Lock-in and the developer bait-and-switch

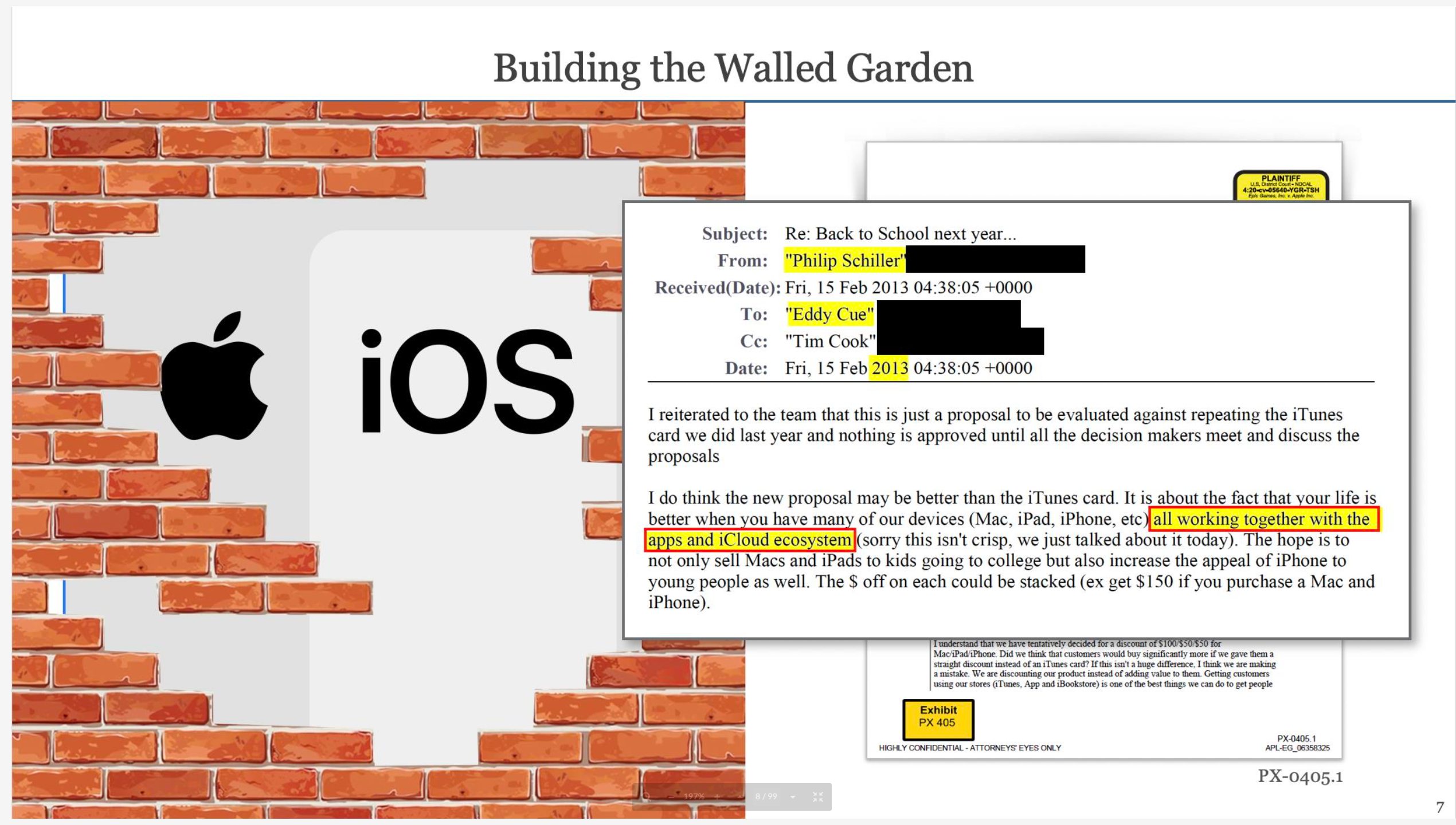

Much of Epic's opening argument focused on the idea that iOS users and developers are effectively locked into Apple's mobile ecosystem and that Apple knew from early in the iPhone's history "what it needed to do to lock users in." Epic produced a number of emails from Apple executives intended to demonstrate this argument, including a 2013 email from Eddy Cue regarding how to get users "hooked to the ecosystem."

As Cue wrote to Apple's Tim Cook and Phil Schiller in 2013:

The more people use our stores, the more likely they are to buy additional Apple products and upgrade to the latest versions. Who's going to but a Samsung phone if they have apps, movies, etc., already purchased? They now need to spend hundreds more to get to where they are today.

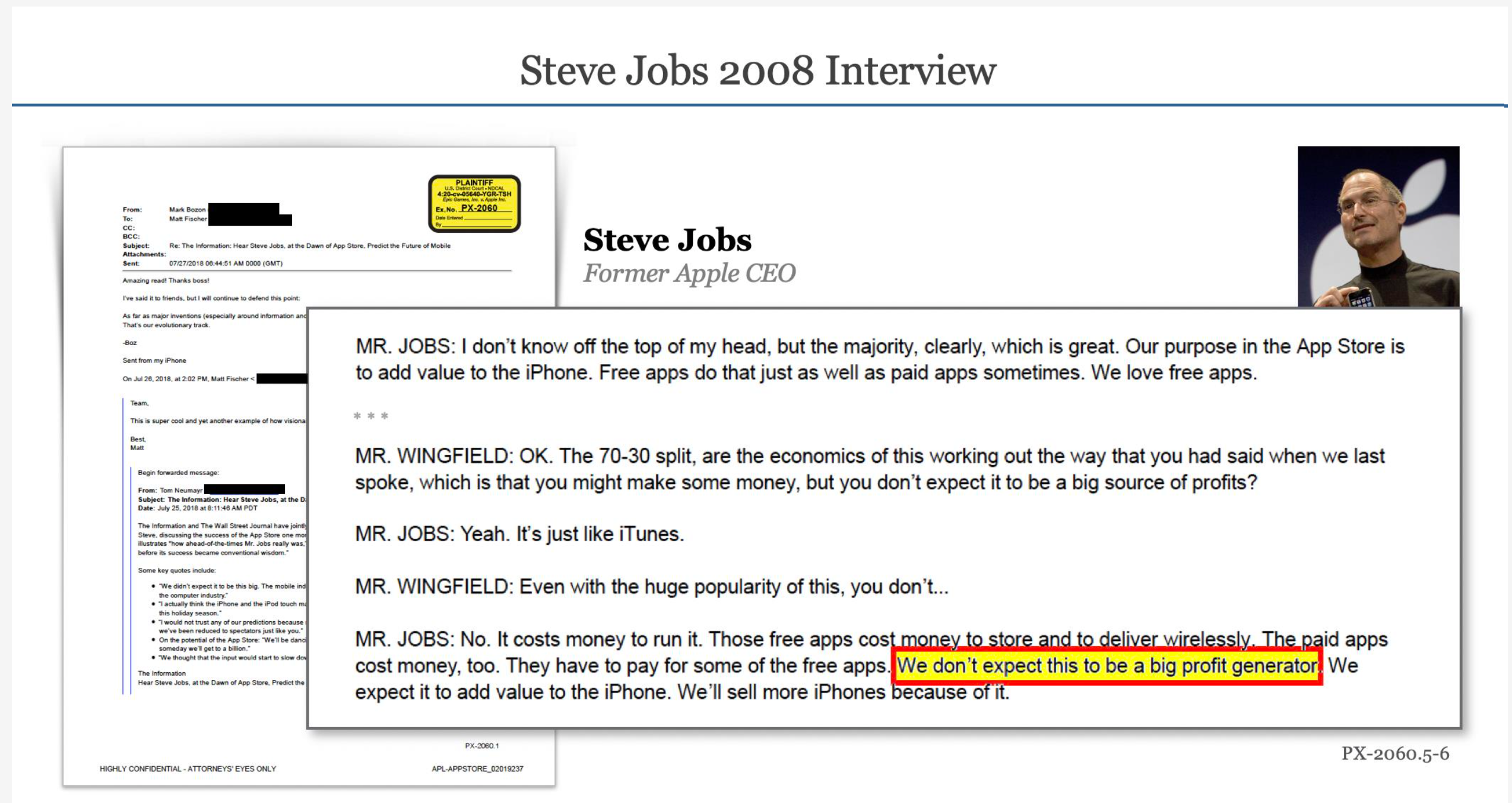

Epic said Apple lured in developers with an initial promise that the App Store itself wasn't going to be a major profit generator for Apple. Steve Jobs said in 2008 that the company didn't "intend to make money off the App Store," instead using the existence of an app marketplace to increase the value of profitable iOS hardware itself.

That worked well for everyone at first, in Epic's telling. But around 2008, Apple realized that some free iOS games were beginning to sell additional levels "for a fee." Apple VP Greg Joswiak identified that in an email as "a possible leak in the system" and said "we'll have to make sure our terms don't allow this." In 2009, a new requirement was imposed to use Apple's in-app purchase (IAP) system for such sales, complete with a 30 percent cut to Apple. By 2011, subscriptions made through apps also came with the same requirements.

Epic argued this imposition of in-app purchase fees was capricious, and had nothing to do with security risks, the amount of support offered by Apple, or the costs of processing user payments. And Epic points out that Apple eventually cut its asking fee to 15 percent for the second year of auto-renewing subscriptions, despite there being no change in costs. "There's a name for businesses that set prices without regards to costs," Epic's lawyer said. "Monopolies." All in all, this email's just another brick in the wall (of Apple's walled garden).Apple vs. Epic court documents

All in all, this email's just another brick in the wall (of Apple's walled garden).Apple vs. Epic court documents If MacOS is secure, as Apple suggests, then Epic wonders why iOS needs additional security in the form of total App Store control...Apple vs. Epic court documents

If MacOS is secure, as Apple suggests, then Epic wonders why iOS needs additional security in the form of total App Store control...Apple vs. Epic court documents Steve Jobs didn't expect the app Store to be a profit driver for Apple...Apple vs. Epic court documents

Steve Jobs didn't expect the app Store to be a profit driver for Apple...Apple vs. Epic court documents ... but Steve Jobs did not know what was coming.Apple vs. Epic court documents

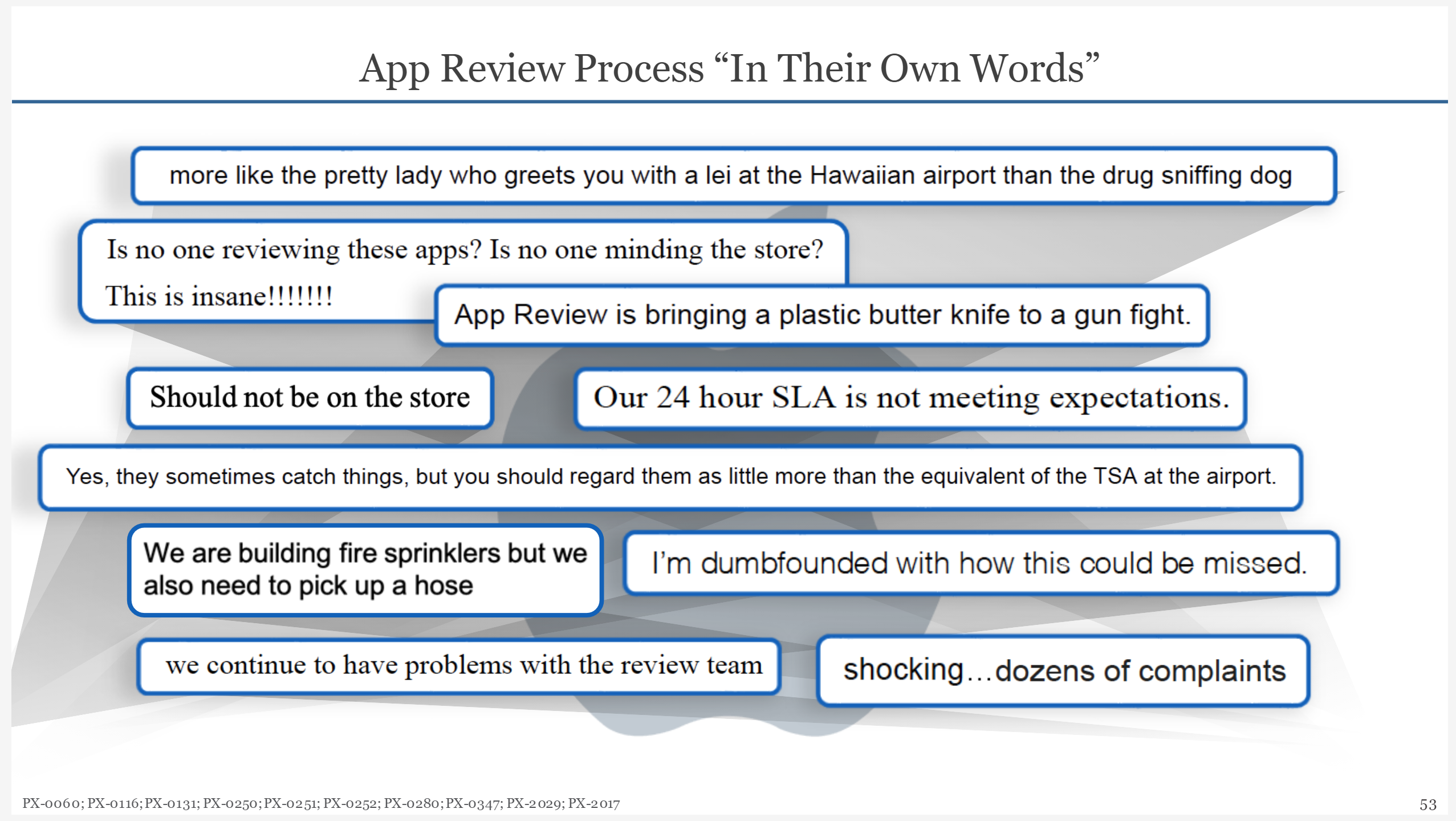

... but Steve Jobs did not know what was coming.Apple vs. Epic court documents A sampling of developer reactions to iOS App Store review.Apple vs. Epic court documents

A sampling of developer reactions to iOS App Store review.Apple vs. Epic court documents Fortnite is more than a game, Epic argues. It's the beginning of an entire metaverse.Apple vs. Epic court documents

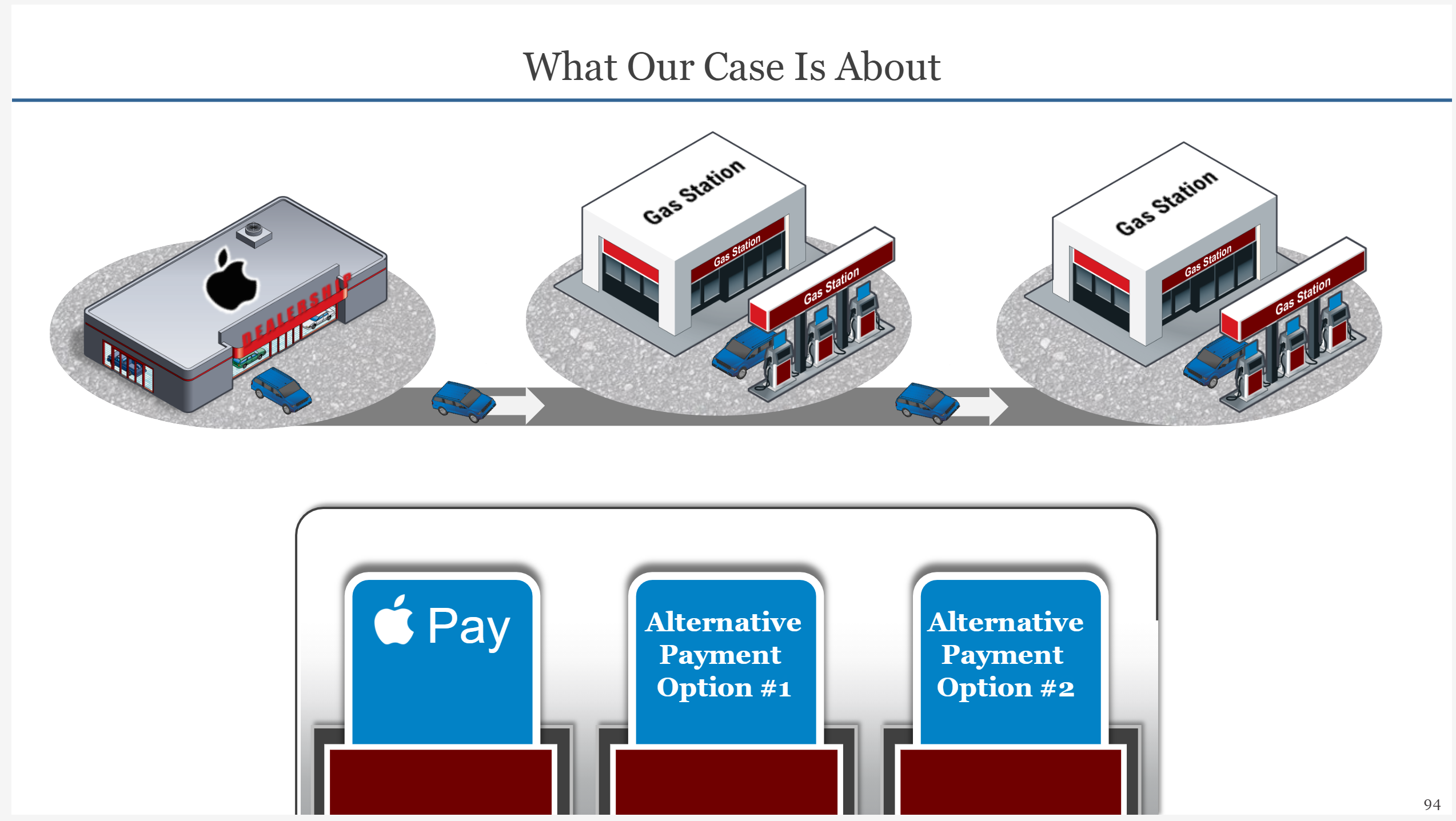

Fortnite is more than a game, Epic argues. It's the beginning of an entire metaverse.Apple vs. Epic court documents iOS app distributions should be more like gas stations, Epic argues, where a variety of providers can service the same car after it leaves the lot.Apple vs. Epic court documents

iOS app distributions should be more like gas stations, Epic argues, where a variety of providers can service the same car after it leaves the lot.Apple vs. Epic court documents

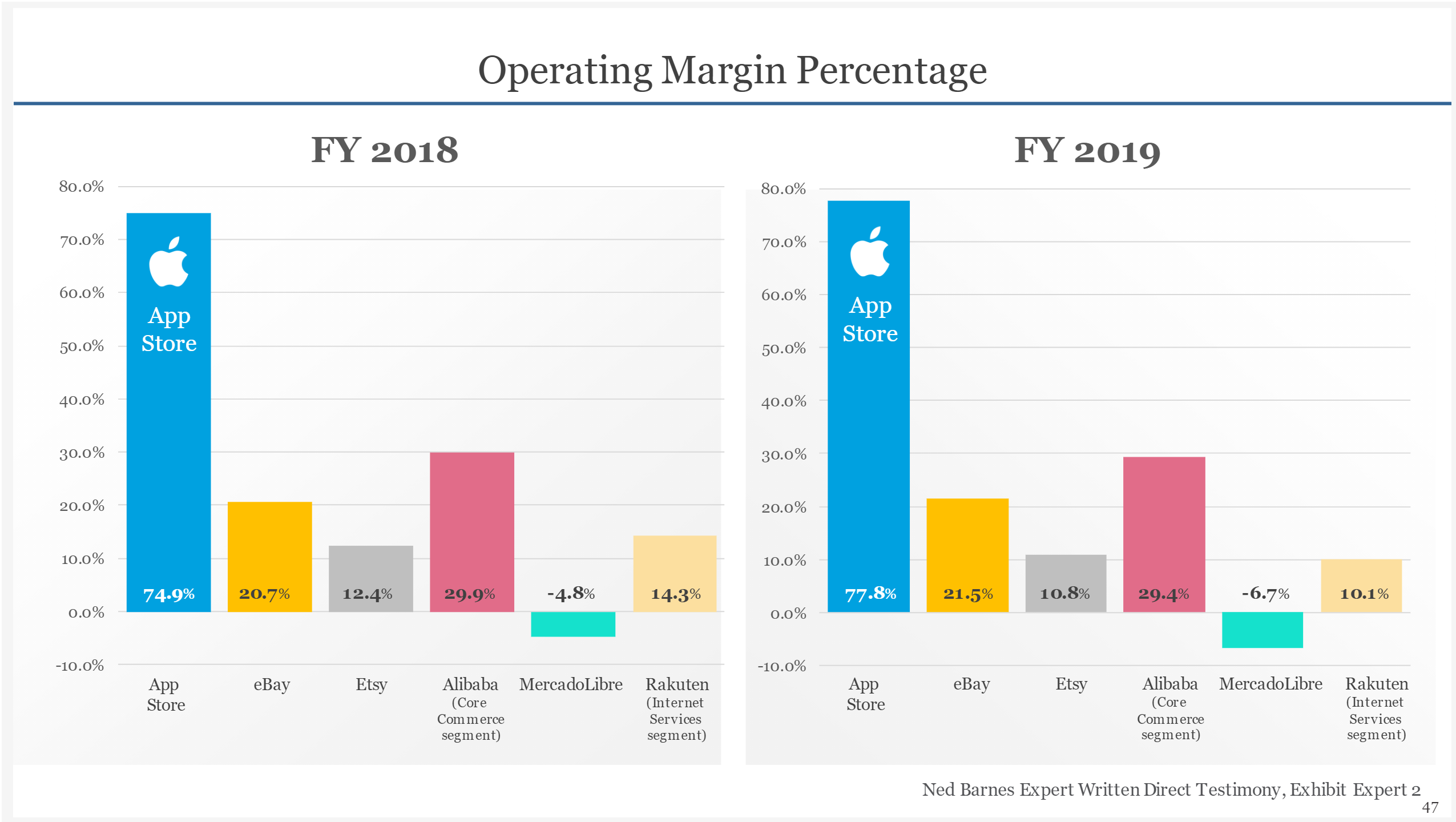

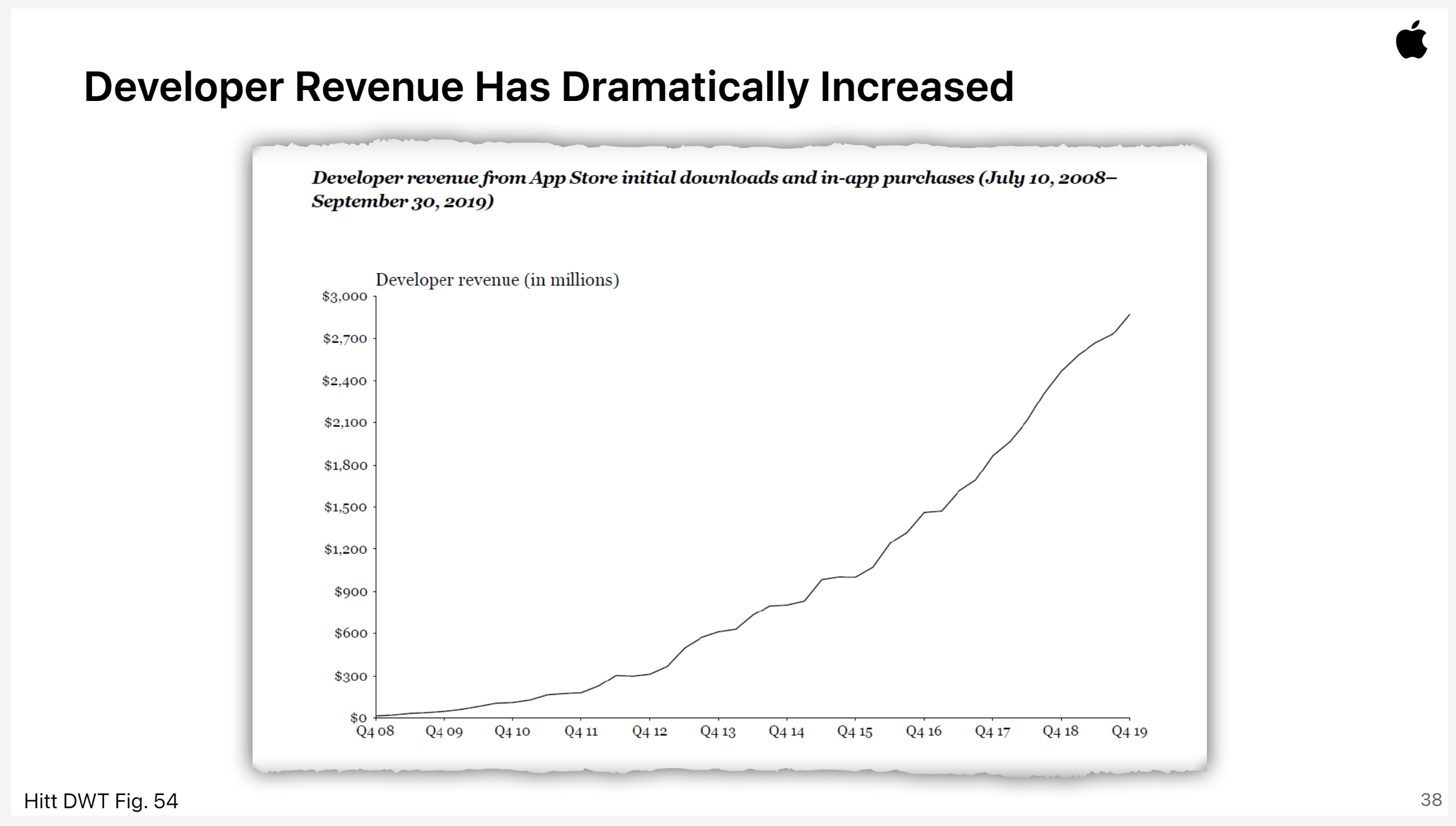

Despite Jobs' expectations, Epic says internal Apple documents show the iOS App Store now makes profit margins in excess of 75 percent on hundreds of millions of dollars in annual revenue. Apple says these numbers are misleading and don't account for iOS SDK and API costs that are filed in other portions of the company, such as the software division.

In any case, Epic characterized this massive profit-taking on app revenue as a bait-and-switch by Apple. "The most appealing flower in the garden was a venus fly trap," Epic counsel said. Developers "helped add value to iOS, and once they committed to the iOS ecosystem... their businesses depended on Apple."

Consumers, meanwhile, have invested real, sunk costs into the iOS ecosystem and would incur significant costs from switching, Epic said. Epic cited studies showing "a developer like Epic could not leave the iOS platform even in the face of a price increase without suffering a loss of profit."

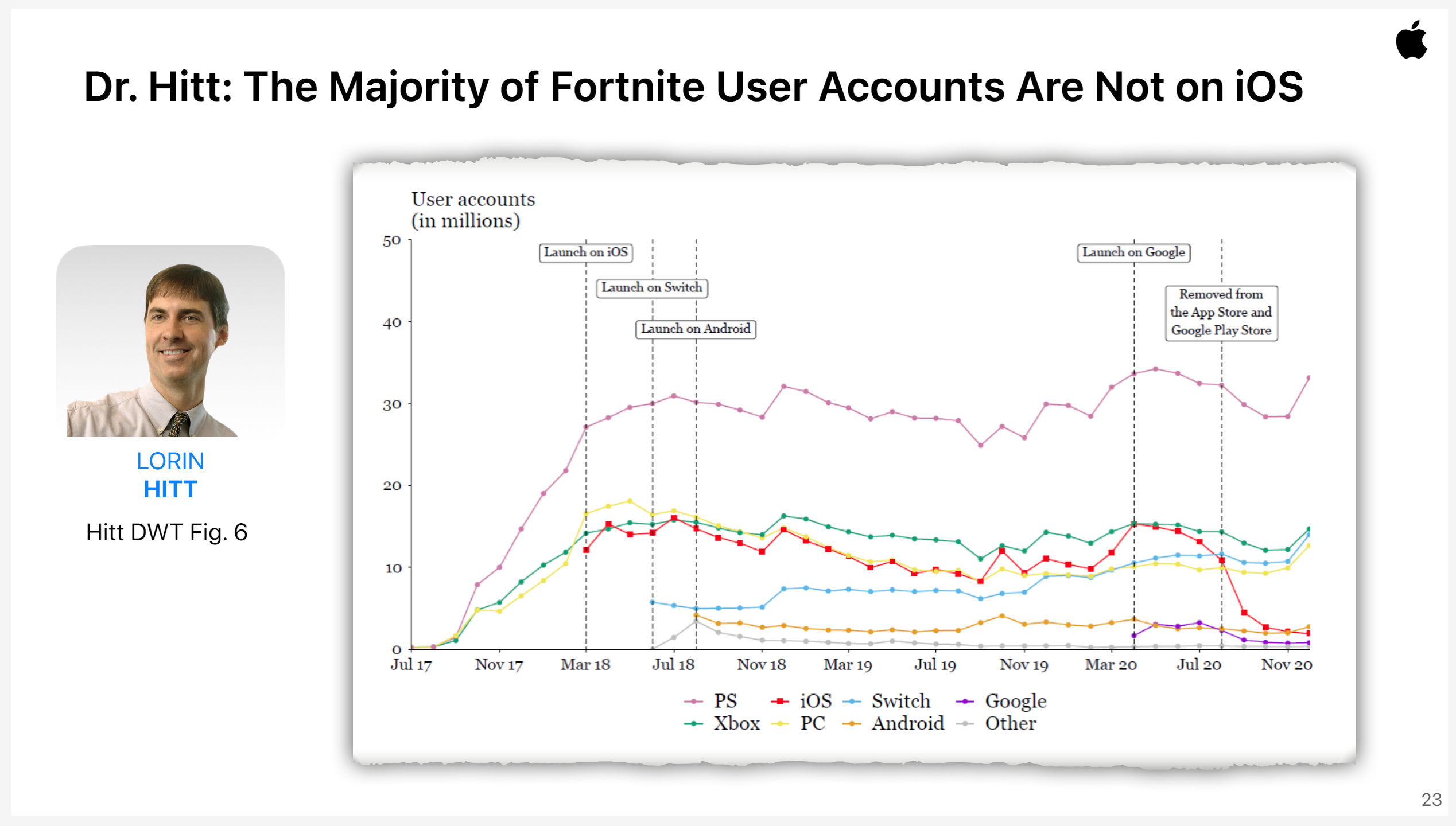

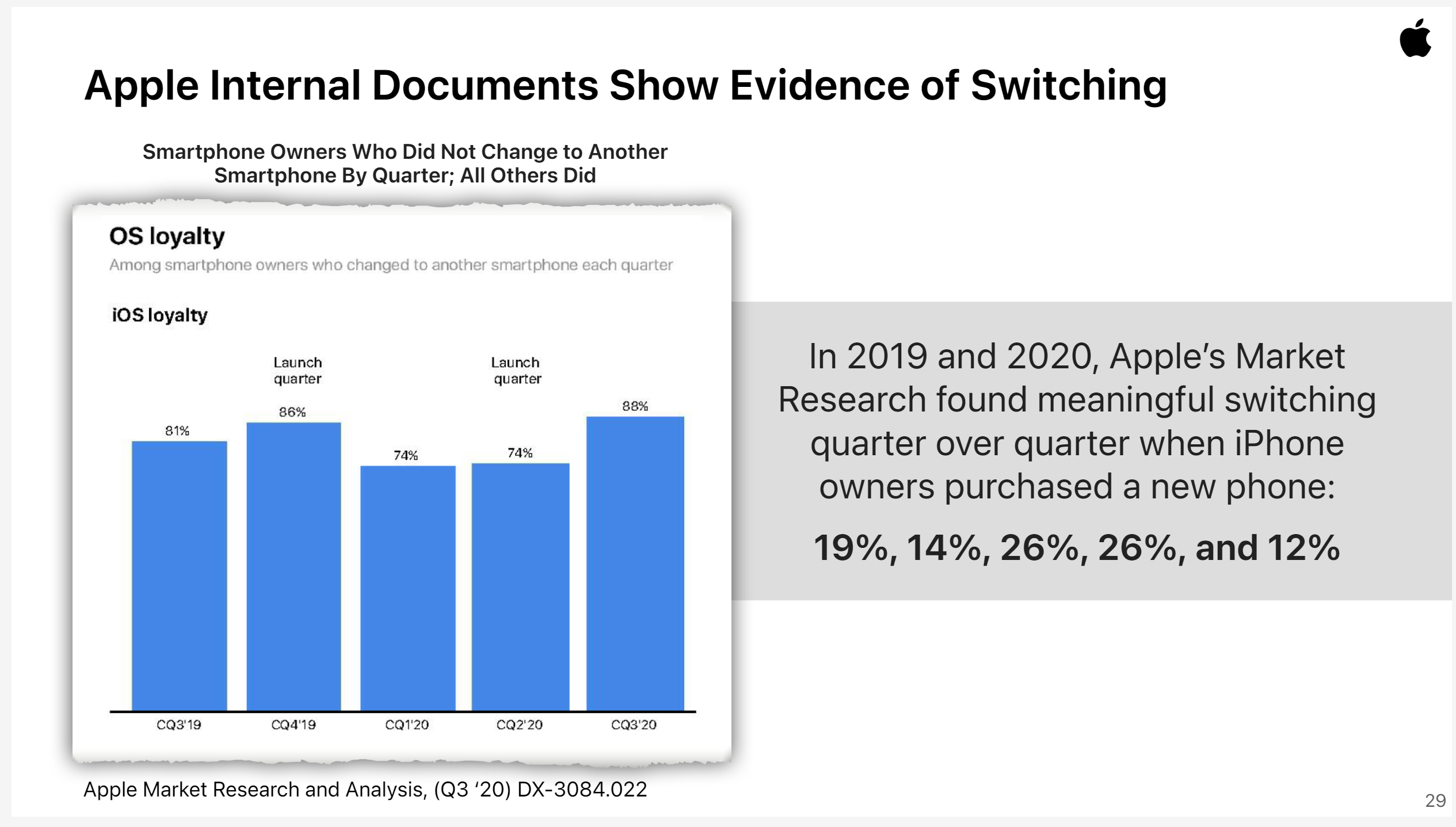

But Apple cited its own data to suggest that anywhere from 12 to 26 percent of iOS users who purchased a new phone in recent quarters switched to a different mobile platform, showing that there are competitive alternatives even for users who have been allegedly "locked in." And when iOS usage of Fortnite shrank after its iOS App Store removal, play on competing gaming platforms went up concurrently, according to data Apple presented, suggesting further alternatives in that use case.

Security precaution or pretext

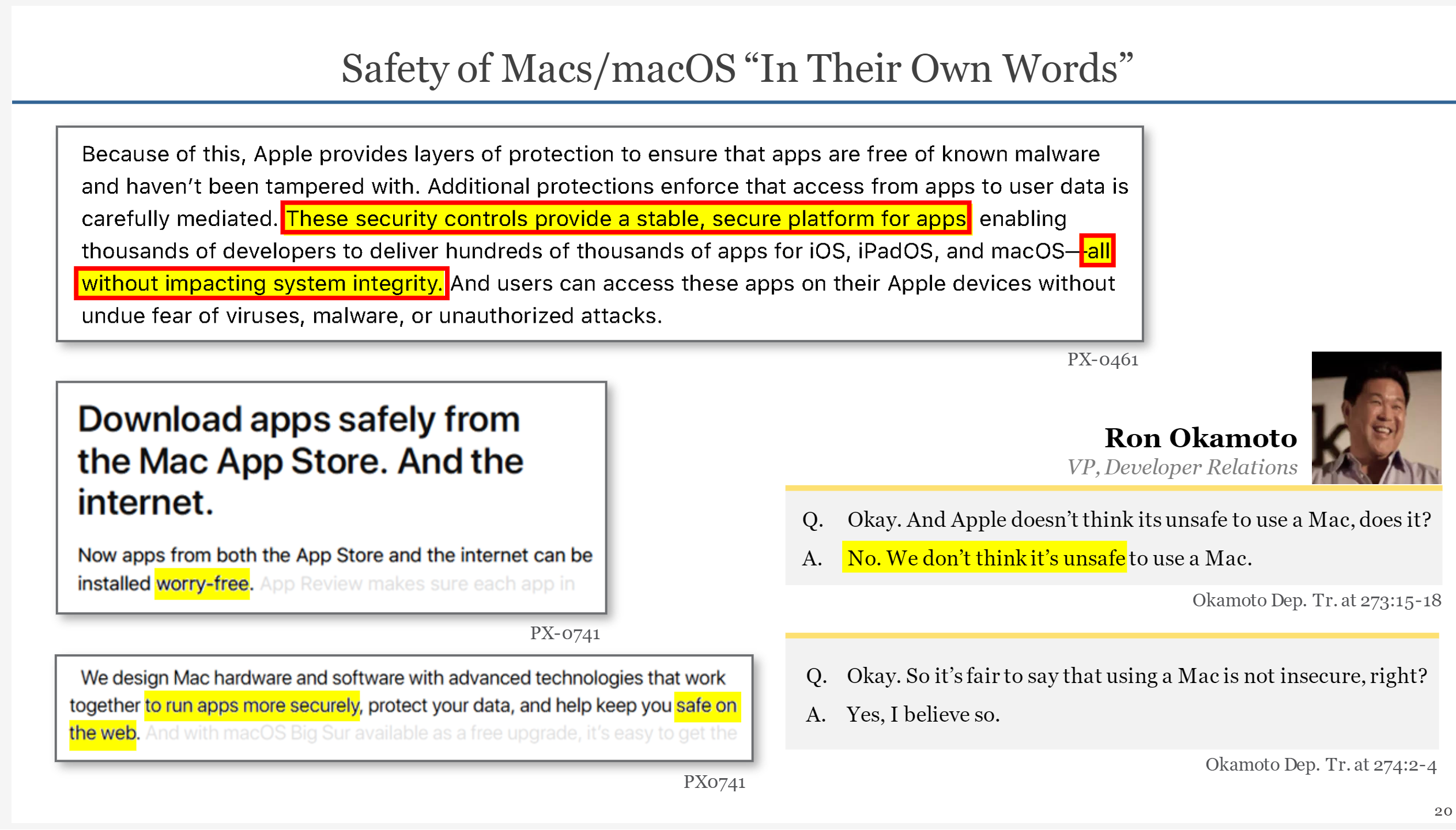

Epic argued that Apple could have built the iOS' software "walled garden" with a door, as it did for MacOS, which shares the same kernel yet allows for the installation of unsigned apps not sold through Apple's official Mac App Store. Forcing iOS apps through the App Store and its review process was "not a technical decision, but a policy one" Epic argued.

But Apple answered that locking down the iOS App Store was also a security decision and that "putting [unreviewed] native third-party apps on the iPhone could compromise the phone itself." A mobile device provides a larger and more attractive attack surface than a desktop OS, Apple argued, thanks to the mobile device's additional capabilities and near-constant powered-on status. This requires additional security layers to protect users, Apple said.

"It is a rare moment when someone leaves a Mac on a bus or a movie theater," Apple's lawyers said. "A Mac doesn't know where you are or you children are."

Epic said that argument is just a pretext for what amounts to a business decision to exert total control over the iOS app marketplace. Epic counsel quoted Apple executives and materials saying that MacOS is secure, and counsel argued that there is "no [security] failing in MacOS that iOS has cured."

“Rather than investing in innovation, Epic [is] investing in lawyers and PR... to get the benefits that Apple provides for free.”Apple opening arguments

Epic also cited experts who will argue in court that the majority of iOS security is achieved at the OS level and that App Store review "is not significantly adding to the security of the iOS platform." Most iOS security features have nothing to do with how the app got on the iPhone in the first place, Epic said, and the review process still lets in plenty of scam or copycat apps despite Apple's best efforts.

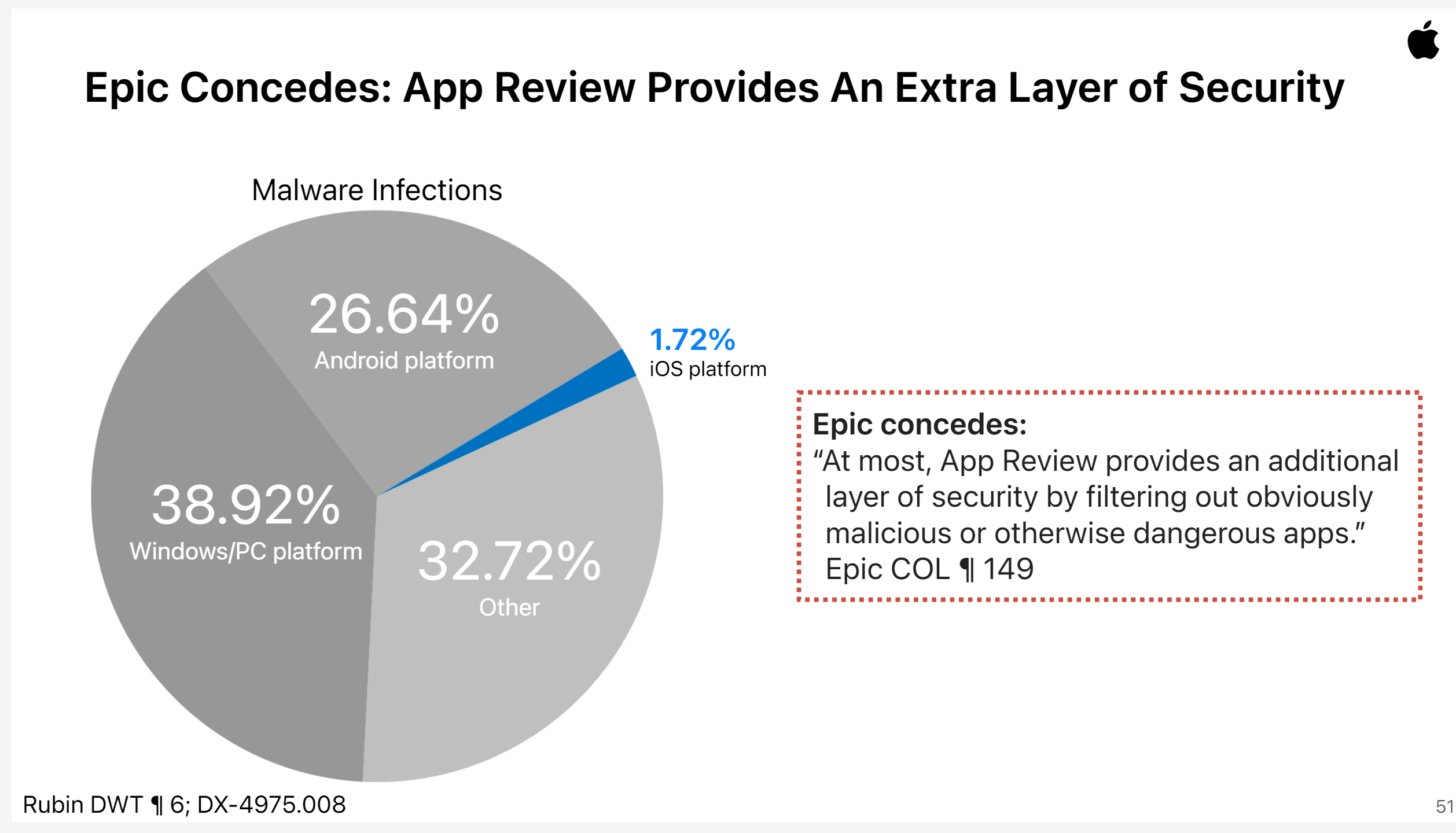

Apple's counsel "freely acknowledge[d] app review is not perfect," but counsel also argued that Epic is asking the company to remove an extra layer of security that has stopped hundreds of thousands of apps with malware, privacy violations, or objectionable/illegal content from making it onto iOS devices. This alone proves that the security benefits of App Store review are not just a pretext and that "most people would think this is pretty important."

Apple also cited statistics showing Android has orders of magnitude more malware incidence thanks to its more open nature and the option to sideload apps obtained from outside the Google Play store. "Epic wants us to be Android, but we don't want to be," Apple argued. "Our consumers don't want us to be."

Epic, meanwhile, said it doesn't want to turn iOS into Android but is asking Apple to apply the highly secure MacOS model, "a model Apple itself designed," for its mobile app distribution as well.

Defining the competition

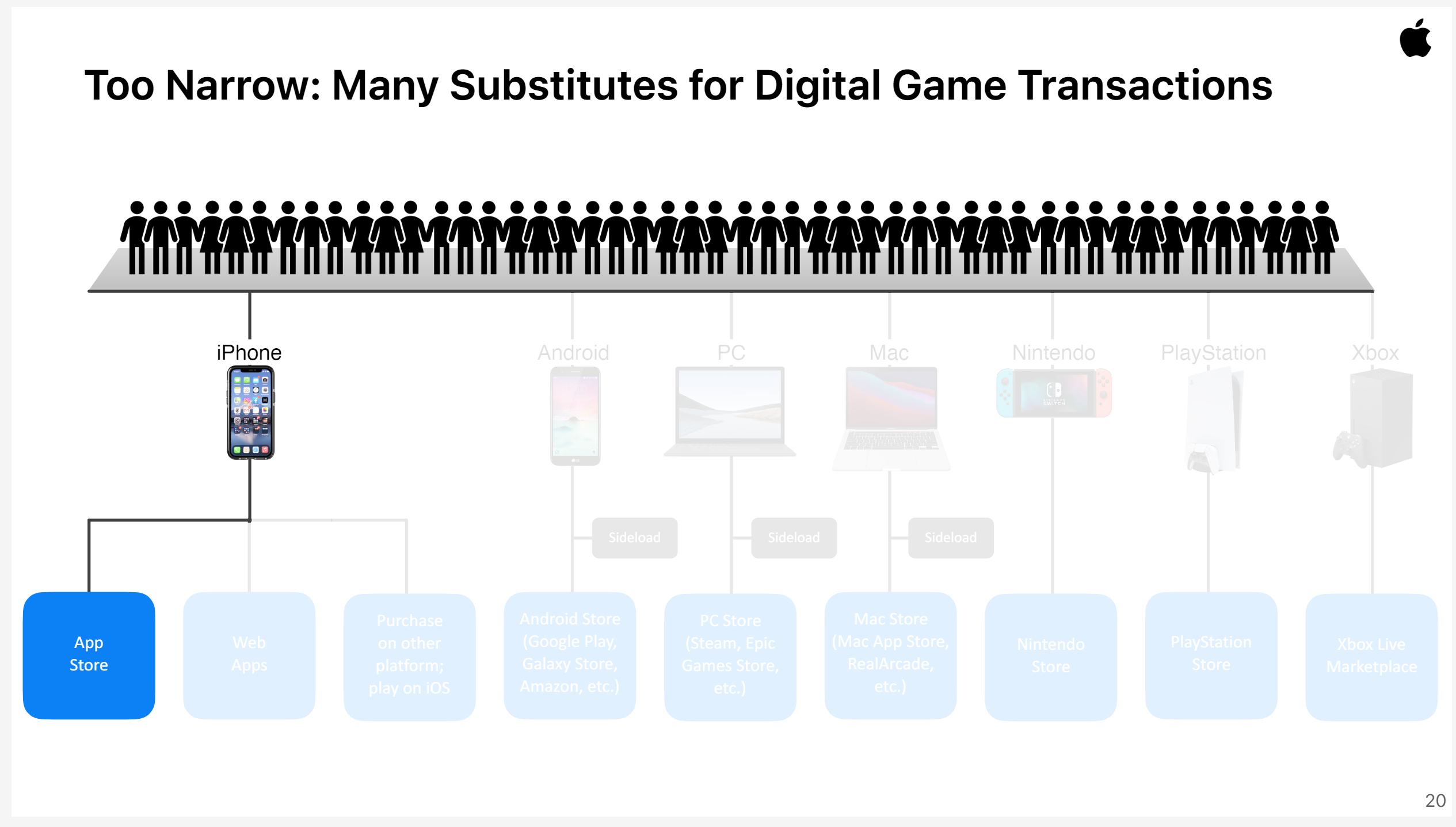

Much of Apple's opening arguments focused on the legal definition of the relevant markets that Apple is allegedly monopolizing. While Epic argued that the markets for iOS apps and in-app purchases represent such a market, Apple said that determination is both too narrow and too broad.

Apple says its 30 percent App Store commission is in line with industry standards.Apple vs. Epic court documents

Apple says its 30 percent App Store commission is in line with industry standards.Apple vs. Epic court documents While Epic wants to say the iOS App Store is a market unto itself, Apple says it's just a sliver of a much larger competitive market.Apple vs. Epic court documents

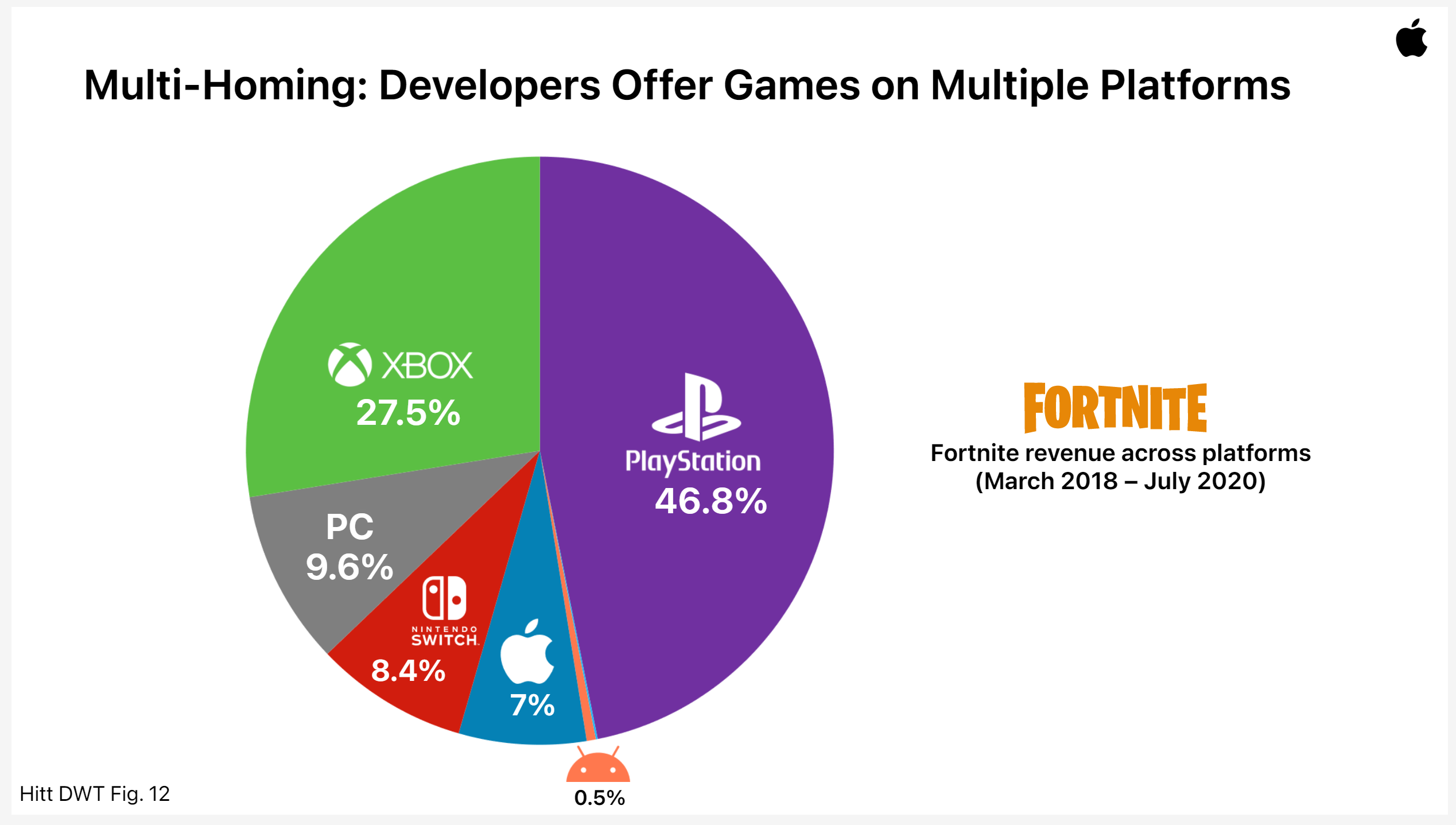

While Epic wants to say the iOS App Store is a market unto itself, Apple says it's just a sliver of a much larger competitive market.Apple vs. Epic court documents Despite Apple's alleged "monopoly control," it argues iOS is just a small sliver of total Fortnite revenues.Apple vs. Epic court documents

Despite Apple's alleged "monopoly control," it argues iOS is just a small sliver of total Fortnite revenues.Apple vs. Epic court documents When Fortnite was barred from the iOS App Store, play on other platforms increased as it decreased on iOS, showing the viability of alternatives, Apple says.Apple vs. Epic court documents

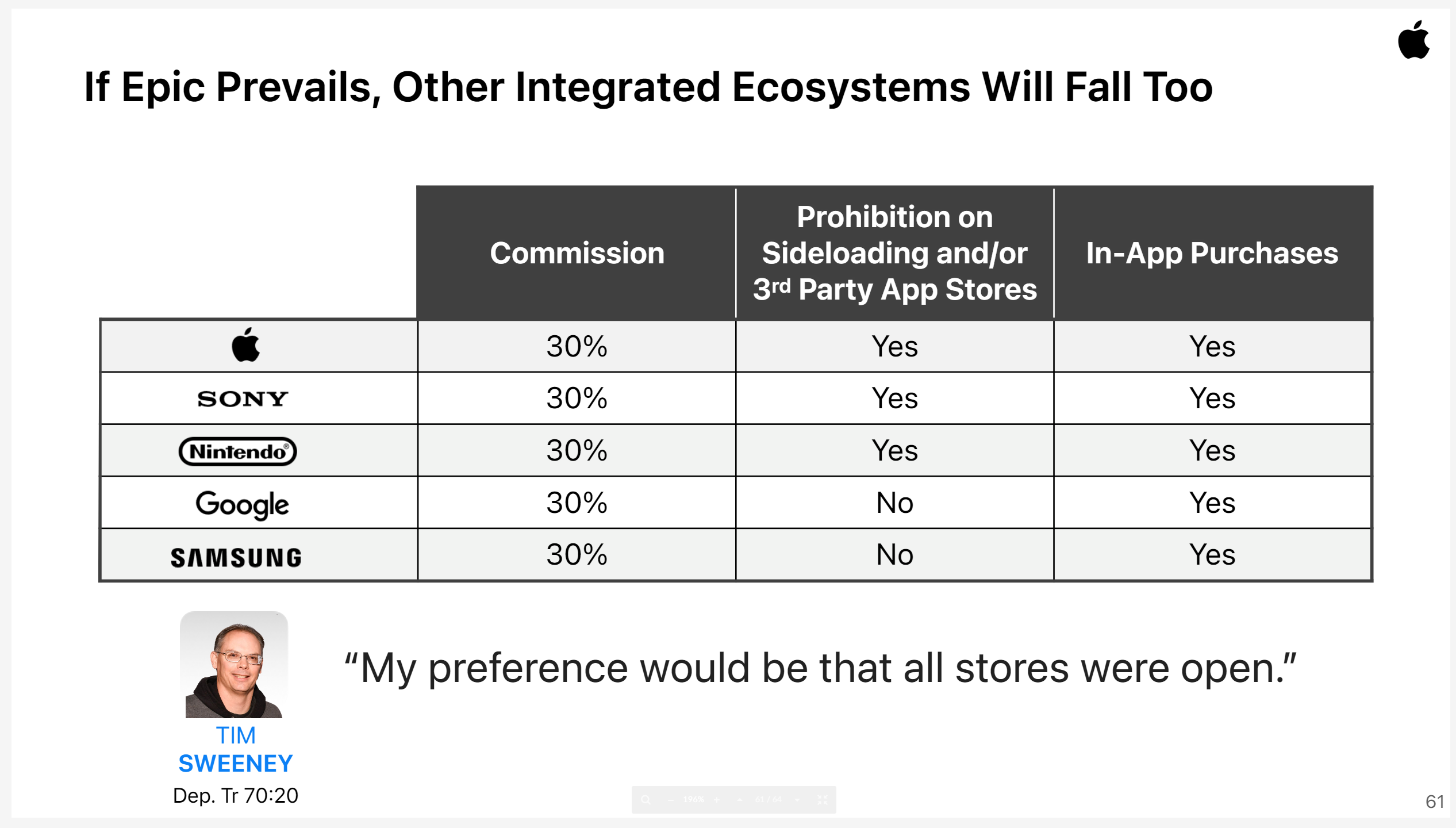

When Fortnite was barred from the iOS App Store, play on other platforms increased as it decreased on iOS, showing the viability of alternatives, Apple says.Apple vs. Epic court documents What's the difference between iOS and major console platforms? Absolutely nothing, Apple says.Apple vs. Epic court documents

What's the difference between iOS and major console platforms? Absolutely nothing, Apple says.Apple vs. Epic court documents Apple's tight control of the App Store is part of why it's more secure than other platforms, Apple argues.Apple vs. Epic court documents

Apple's tight control of the App Store is part of why it's more secure than other platforms, Apple argues.Apple vs. Epic court documents Apple uses overall developer success on the App Store to argue its control of the space has been beneficial to competition.Apple vs. Epic court documents

Apple uses overall developer success on the App Store to argue its control of the space has been beneficial to competition.Apple vs. Epic court documents A small chunk of iOS users switch to competing mobile platforms each quarter, a fact Apple says prove there is no "lock-in" effect.Apple vs. Epic court documents

A small chunk of iOS users switch to competing mobile platforms each quarter, a fact Apple says prove there is no "lock-in" effect.Apple vs. Epic court documents

The market as Epic defined it is too narrow, Apple said, because there are plenty of competing platforms for video games like Fortnite, including new ones like Stadia and Luna which are accessing mobile platforms via open web browsers. Most iOS Fortnite players have access to another device that can play the game, according to Apple's studies, and iOS was only the third- or fourth-most popular Fortnite platform even before it was removed from the App Store, with the vast majority of players going through Xbox or PlayStation consoles.

Apple also points to the ability for players to purchase Fortnite V-Bucks on one platform and spend them on another as an indication that it does not exercise monopoly control over Epic's relevant market in this case. And the ability of Fortnite players and others to play the same game cross-platform with those on different hardware shows just how broad the market is.

What's more, Apple said Epic knows there are competitive alternatives to iOS for Fortnite. It cited an email from Epic CEO Tim Sweeney to Microsoft last year alluding to "certain plans for August" that would "[create] opportunities for consoles... in contrast to mobile platforms, and to onboard new console users." The clear implication, Apple argued, is that Epic knew that its August 2020 battle with Apple would have benefits to iOS gaming competitors such as the Xbox.

“There’s a name for businesses that set prices without regards to costs: monopolies.”Epic opening arguments

At the same time, Epic's proposed market of all iOS apps is too broad, Apple said, because it includes too many types of apps. A game like Fortnite is not a suitable replacement for a traffic app like Waze or a restaurant app like Starbucks, Apple's counsel argued.

Apple also argued that the massive growth in iOS users, app downloads, and developer revenues over the last decade show that there has been no anticompetitive harm to its "walled garden" approach to iOS apps. "Epic says that Apple has failed to deliver on this," counsel said. "This is delivery!"

Meanwhile, because the vast majority of iOS games are free and many are monetized in ways other than in-app purchases (such as ads or external subscriptions), Apple says it only takes an "effective commission" of 8.1 percent for all iOS gaming revenues, much lower than the 30 percent headline number.

Grave warnings

Epic likened the ideal iOS app model to that of a car dealership. While the dealer can take a commission on the sale of the car itself, it can't set an ongoing commission structure for the sale of gas for that car. Epic is "simply seeking the possibility of alternatives... at the gas pump." And even in the case of free apps, Epic said its evidence will show other ways that Apple benefits monetarily as the creator of iOS, even without a direct commission.

But Apple argued that, if Epic prevails in this case, app makers will be able to benefit from Apple intellectual property—such as SDKs and APIs—without paying anything to Apple. It compared the iOS app marketplace to those for game consoles and argued that "the law protects Apple's choice to have a closed system just as it protects Sony and Nintendo."

Acceding to Epic's demands in this case "would undo everything Apple has built and that users love," and it would amount to "asking for government intervention to take away a choice users currently have," Apple argued. If Epic wins this case, Apple said, the result will be "less security, less reliability, less quality, [and] less choice."

https://ift.tt/3xN2AOT

Technology

No comments:

Post a Comment